Adding money directly to your account. Understand that contributions are matter to annual IRA contribution restrictions set by the IRS.

Research: It's identified as "self-directed" for any reason. By having an SDIRA, you're solely to blame for completely researching and vetting investments.

Entrust can guide you in getting alternative investments together with your retirement money, and administer the shopping for and promoting of assets that are usually unavailable by banking institutions and brokerage firms.

This information supplied by Charles Schwab Corporation Here's for standard informational functions only, and isn't intended to become a substitute for particular individualized tax, lawful, or investment planning assistance.

Compared with shares and bonds, alternative assets will often be tougher to market or can come with rigid contracts and schedules.

Be accountable for how you develop your retirement portfolio by using your specialised awareness and passions to take a position in assets that match using your values. Received experience in real estate or non-public equity? Utilize it to assist your retirement planning.

For those who’re searching for a ‘set and forget about’ investing strategy, an SDIRA most likely isn’t the best preference. As you are in total Manage above every single investment designed, It is really your choice to perform your individual research. Don't forget, SDIRA custodians are certainly not fiduciaries and cannot make recommendations about investments.

Greater Fees: SDIRAs often come with larger administrative charges in comparison to other IRAs, as specific facets of the administrative procedure cannot be automatic.

And because some SDIRAs which include self-directed standard IRAs are issue to needed least distributions (RMDs), you’ll have to prepare in advance to make certain that you may have sufficient liquidity to satisfy The principles established via the IRS.

Right before opening an SDIRA, it’s imperative that you weigh the opportunity advantages and disadvantages based on your unique money ambitions and danger tolerance.

Confined Liquidity: A lot of the alternative assets that could be held in an SDIRA, such as real estate property, private fairness, or precious metals, might not be conveniently liquidated. This can be a difficulty if you must access cash quickly.

Have the freedom to take a position in Pretty much any type of asset having a possibility profile that matches your investment approach; like assets that have try this web-site the prospective for a greater price of return.

A self-directed IRA is an very strong investment car, but it really’s not for everyone. As being the declaring goes: with great electricity will come fantastic accountability; and with an SDIRA, that couldn’t be additional true. Keep reading to know why an SDIRA might, or might not, be in your case.

SDIRAs in many cases are used by fingers-on investors who're willing to tackle the challenges and duties of selecting and vetting their investments. Self directed IRA accounts will also be perfect for investors who have specialised information in a niche sector they would like to spend money on.

Opening an SDIRA can present you with entry to investments Ordinarily unavailable by way of a bank or brokerage firm. Here’s how to start:

Criminals often prey on SDIRA holders; encouraging them to open up accounts for the goal of making fraudulent investments. They usually fool traders by telling them that In case the investment is approved by a self-directed IRA custodian, it needs to be legitimate, which isn’t accurate. Once more, pop over here Ensure that you do comprehensive research on all investments you select.

Even though there are several Added benefits affiliated with an SDIRA, it’s not without the need of its have downsides. Several of the frequent explanations why buyers don’t opt for SDIRAs incorporate:

Complexity and Duty: Using an SDIRA, you might have additional Command in excess of your investments, but You furthermore mght bear much more duty.

Larger investment options implies you may diversify your portfolio further than shares, bonds, and mutual resources and hedge your portfolio against marketplace fluctuations and volatility.

No, you cannot spend money on your own private business which has a self-directed IRA. The IRS prohibits any transactions concerning your IRA plus your individual organization since you, as the operator, are regarded a disqualified individual.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Burke Ramsey Then & Now!

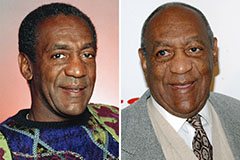

Burke Ramsey Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now!